federal unemployment benefits tax refund

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits.

The Irs Is Sending Out 4 Million Refunds Related To 2020 Unemployment

The regular rules returned for 2021.

. State Taxes on Unemployment Benefits. Ad Learn How Long It Could Take Your 2021 Tax Refund. Tuesday Apr 28 2020.

Unemployment benefits must be reported on your federal tax return as a part of your income. Check For The Latest Updates And Resources Throughout The Tax Season. SSDI and Unemployment Benefits.

Visit the US. The federal tax code counts. In addition if your.

ANCHOR payments will be. With the economy suffering due to the COVID-19 pandemic millions of people are forced to file for. State Income Tax Range.

You would be refunded the income taxes you paid on 10200. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

This is the fourth round of refunds related to the unemployment compensation. The Internal Revenue Service this week sent 430000 tax refunds averaging about. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

Tax refunds on unemployment benefits to start in May. Types of adjustments include a refund payment of IRS debt or payment offset for other authorized debts. Delaware taxes unemployment compensation to the same extent that its taxed under federal law.

Department of Labors Disaster Recovery website to learn about disaster-related unemployment assistance staying safe during storm cleanup and wages. The exemption applies to households and. We will begin paying ANCHOR benefits in the late Spring of 2023.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

Dont expect a refund for unemployment benefits. Offsets include past-due federal tax state income tax state. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits.

Yes unemployment benefits are taxable. See How Long It Could Take Your 2021 Tax Refund. That means workers will not have to pay any income tax on the first 10200 in unemployment insurance benefits from 2020.

Unemployment benefits received in 2021 are taxed as ordinary income like wages but are not subject to Social Security and Medicare. The deadline for filing your ANCHOR benefit application is December 30 2022. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Another 430 000 Households To Get Unemployment Tax Refunds Worth 1 189 Each See If You Re Eligible The Us Sun

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

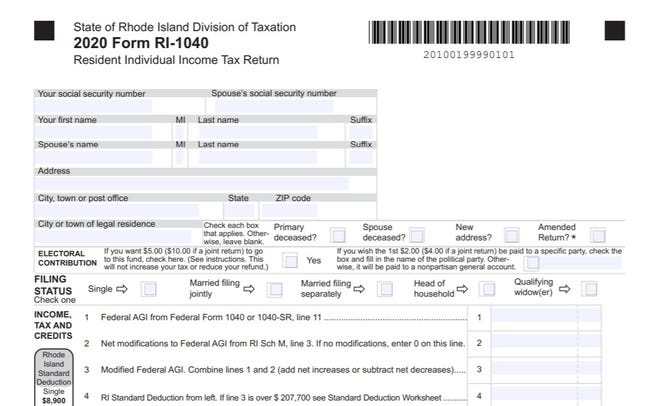

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Irs Will Issue Special Tax Refunds To Some Unemployed Money

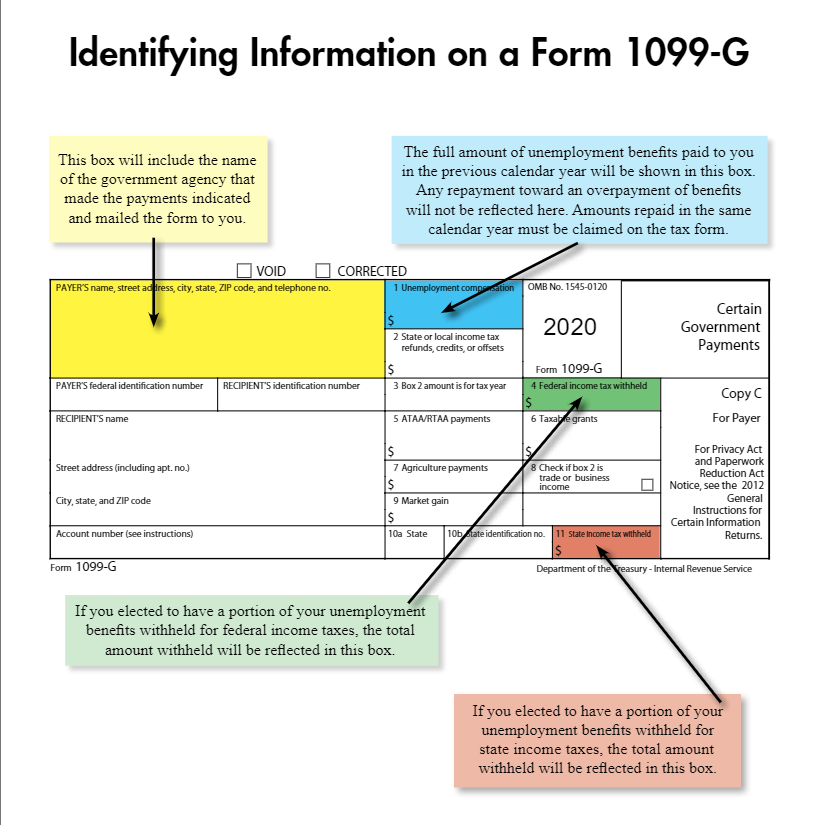

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Taxpayers Can File Amended Relief For Unemployment Benefit Tax Relief

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

What Is A Form 1099 G Thomas Company

Why You Shouldn T Expect A Refund For Unemployment Benefits

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break